Life Insurance is a Love Purchase, but it’s also a Dynamic Financial Vehicle!

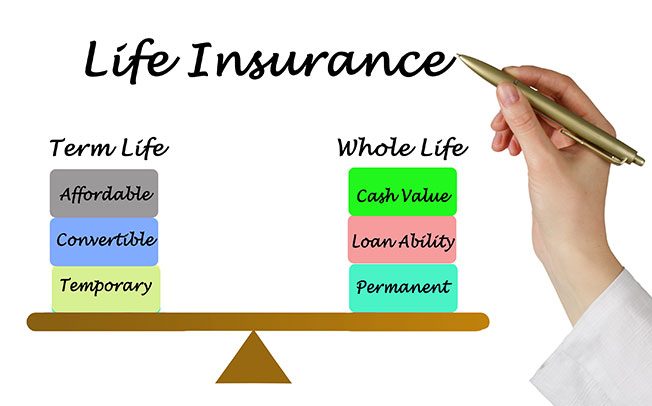

TERM LIFE • PERMANENT LIFE: Indexed Universal Life | Universal Life | Whole Life

- This page is designed to convey preliminary information about various types of life insurance.

- Let our 21 years of experience assist you in finding your best suited policy, and, in planning your life insurance portfolio, properly.

- To find you the best suited coverage, we shop over 30 of America’s Best Rated companies.

Term Life Insurance

Pure Term • Term with Living Benefits • Return of Premium Term (ROP)

For a Free, No Obligation Quote of Your Term Life Options

Pure Term: This is the most basic and widest used life insurance type. It covers the life of an insured for a certain period of between 5 to 30 years, depending on the insured’s selection. A term life insurance policy is guaranteed to stay in-force for the entire duration of the “term” if the premiums are paid regularly. The monthly premium amount is also guaranteed to never increase for the duration of the selected term, e.g. 20 years.

Example: A $500,000, 20 Year Term policy with a monthly premium of $50 will cover the insured’s life for 20 years, with the $50/month premium guaranteed to never change for the full 20-year period.

The primary reason for Term’s popularity is its low cost and affordability.

The Conversion Option, A High Value Feature: A Term policy can be converted (changed) into a Permanent life policy, such as an Indexed Universal life, at any time* during the term of the policy without any medical exam or evidence of insurability. This means that the insured gets to carry over his Term rating, acquired at the policy’s start, to the Permanent policy that he is converting to. Another advantage of the conversion option is that if the Term policy’s rating was not favorable at the policy’s inception, the insured will have the opportunity to improve his rating at the time of conversion by going through a physical exam and a new underwriting, if he felt that he is in better health condition than before.

So, as a rule of thumb: A life insurance policy’s rating can never get worse, but it can always improve. The conversion option is a highly valuable feature of a Term policy which allows an insured with a declined health to convert and obtain a permanent policy without any underwriting. And, being able to carry over his past better rate to the new permanent policy despite his current unfavorable health. On the contrary, if an insured gets a less than favorable rate when purchasing a Term insurance, but at the time of conversion, feels that he is in better health than before, he can request a full underwriting to try to improve his rating going into the permanent policy.

Hence again, A life insurance policy’s rating can never get worse, but it can always improve! And that’s a highly valuable characteristic!

Frankly, just the Conversion Option by itself is enough reason for people in perfect health, regardless of their age, to buy a Term life policy, even if they would feel that they don’t have any need for it! Simply because, by buying a Term insurance, one is essentially cementing his/her current perfect health.

*Exercising the conversion option is subject to age limits, and it varies among companies. The age limit for conversion typically ranges from 65 to 80 years of age which means that if the option is not exercised by then, it will be lost.

*Rating: A life insurance policy’s rate refers to the insured’s health rating, and it is rendered by the life insurance company to the insured after a medical underwriting is completed. To complete an underwriting, some sort of a physical examination is required. A physical examination can be consisted of any of the following: blood & urine draw, physical measurement, medical questionnaire, and EKG. The non-smoker rating designations are generally as follows: Super Preferred, Preferred, and Standard. The Super Preferred is the best rate category which also translates into lower premiums and lower internal policy costs. All expenses of an applicant’s examination and underwriting is covered by the insurance company with no obligation on the part of the applicant.

Term Life with Living Benefits: This type of Term life insurance is designed to disburse cash, “benefits”, to the insured due to certain medical conditions while he is still alive, hence the term “Living Benefits”. The concept is to assist an insured monetarily if he falls ill with a serious medical condition. The assistance is achieved by liquidating a portion of the insured’s death benefit while he is still alive. The triggering illnesses for cash assistance are grouped into 3 medical categories:

Chronic Illness. 2) Critical Illness. 3) Terminal Illness.

Please note that the categories are defined in general terms, however, each individual company’s approach in disbursing benefits may slightly differ from the other. So, let’s take a look at the general definition of each category.

There is a reason that Term life insurance with Living Benefits has become so popular in the past decade! And, it’s the peace of mind of knowing that in case of debilitating illnesses, there will be financial assistance to count on.

Return of Premium Term (ROP): Back in the day, this used to be an extremely popular product, and, whoever got one, is a real winner! However, with the continuous fall of the interest rates, companies started discontinuing this amazing product to a point where today, there is only 3 companies that offer it!

The main concept is that 100% of the policy premiums that are paid during the term of the policy will be returned to the policy owner at the end of the policy term. So basically, an ROP Term insurance has a savings component that essentially functions as a piggy bank! The Return of Premium feature of a Term policy is contractually guaranteed.

Although the premiums of an ROP is about double that of a pure Term, considering that all premiums are returned by the term’s end, the additional premiums are justified. Because, without the additional premiums, the pure term’s base premiums would have essentially been lost if the insured would have still been living by the end of the term. So, from that perspective, it can be observed that the additional premium’s rate of return is the pure term’s premiums that would have otherwise been lost. And, in terms of percentage rate of return, it typically amounts to about 4% annually, which in current low interest environment, it certainly is high for a guaranteed product!

For a Free, No Obligation Quote for all Your Term Life Options

Permanent Life Insurance

An Overview

A Permanent Life insurance policy is one of the most efficient, cost effective & tax advantaged financial instruments available today. Although primarily an insurance product, a permanent life insurance, is often used for retirement planning, college funding, business arrangements, such as Buy & Sell Agreements, and creating opportunity & emergency funds. And, all of this on a Tax-Free basis which makes permanent life insurance to be the best tax shelter in the IRC Tax Code.

In case of insured’s death, a life insurance policy is intended to provide the beneficiaries with a lump sum, tax free, cash amount which in insurance language is known as the policy’s “Death Benefit” or “Face Amount”. Hence, Life insurance is fundamentally a protection mechanism that helps materialize the hopes & dreams of an insured person for his family. In the unfortunate event of an insured’s passing, his beneficiaries can choose to utilize the tax-free death benefit however they see fit, or, in accordance with the insured’s written will. Life insurance proceeds are typically used to pay off mortgages, fund children’s college education, & pay for other living expenses.

As the name suggests, a Permanent life insurance policy, unlike Term, has the potential to remain enforce for the entire life of the insured, no matter in what age the insured dies. All Permanent life policy factors, such as the health rate and the premium amounts, are guaranteed to remain the same throughout the life of the policy.

As in a Term policy, the premiums of a Permanent life policy are also determined by the following four factors: 1) the policy’s face amount, 2) insured’s age, 3) gender, 4) the Insured’s health rating which is determined through a medical underwriting process at no cost to the insured.

Types of Permanent Life Insurance: The most common types of Permanent Life insurance policies are: 1) Indexed Universal Life (IUL), 2) Universal Life (UL), 3) Whole Life, and 4). Variable Universal Life [VUL],

Universal Life: An Overview & A Bit of History

Universal Life represents the idea of combining a Term insurance with a saving component. The genesis of the idea can be traced back to Canada in 1962 where an actuarial expert by the name of G.R. Dinney invented the idea. However, it was not until 1971 that G.R. Dinney, in his presidential address to the Canadian Institute of Actuaries, officially presented Universal Life as an insurance product. It took 4 years for G.R. Dinney’s idea to be marketed as a viable insurance product by Canada’s Cannibal Life insurance company in 1975.

In 1979, Life Insurance Company of California which later changed its name to E.F. Hutton Life started to successfully market the Universal Life insurance product in the U.S. A few small companies followed the lead of Hutton in 1980, and 1981 saw the entrance of major companies into the Universal Life market. By the end of 1983, nearly all major insurers had introduced at least one Universal Life product, and the rest is history. During high interest rate periods, between late 1970’s and mid 1980’s, the Universal Life was particularly attractive since people had the opportunity to earn a net double digit return on a UL policy’s cash value!

In explaining the types of Universal Life policies, it should be noted that their chassis are fundamentally the same. However, their major difference is in the way that their saving component, namely the “cash value”, gets credited.

Universal Life policies are consisted of two main components: “Death Benefit”, or the policy’s insurance side, also known as “Face Amount”, and, “Cash Value”, or the policy’s saving component. Although the premiums of a Universal Life policy are theoretically considered to be flexible, we always encourage our clients to pay maximally into such policies, and, use the “flexibility” option only in emergencies. Premium flexibility means that there is a minimum and a maximum premium amount within a Universal Life policy’s structure. So, the premiums of a UL policy can be either the minimum amount or the maximum, or, any amount in between. This “Premium Flexibility” feature allows a policy owner to reduce his premiums for a short or extended period of time, in case of a life event that might make the move necessary.

Universal Life (UL): Most of what has been explained in the “Overview” section pertains to a UL policy! The UL is the original chassis that established itself as a strong and viable new life insurance product during the early 1980’s, mainly due to the high interest rates of the time.

The cash value of a UL policy grows via earning interests, hence, in the current, historically low interest rate environment, the UL cash value accumulation potential has declined dramatically. So, in a stark contrast to the 1980’s, the purchase of a UL policy today would mainly be for 2 purposes: 1) To have a low-cost permanent policy. 2) To have a Permanent policy that is guaranteed to stay in-force for life, as long as the premiums are paid regularly and on time.

Even in the current low interest rate environment, a UL policy can be designed to be paid off, just like a home, in a period of the policy owner’s choosing, e.g. 15 years, or 20 years, etc.

In Today's Market, the Treditional Universal Life is the Lowest Cost Permanent Life Insurance.

Let Us “Shop Around” For Your Top 5, Lowest Cost, Universal Life Quotes

No Cost, No Obligation

Indexed Universal Life (IUL): The advent of Indexed Universal Life (IUL) in 1997 was certainly one of life insurance industry’s most notable milestones in creativity and innovation. IUL is certainly a unique insurance and financial product that brings about features unlike anything that has ever been seen before in any other type of financial product. Besides being a protective measure, vis a vis life insurance, IULs are also a strong asset class that are used regularly in retirement planning.

The main “magic” of an IUL is the way its cash value is structured. The cash value is linked to an economic index such as the S&P 500, allowing it to earn market like returns, while being guaranteed against all market losses. In case of an economic decline, hence market losses, the cash value of an IUL gets zero credit for that negative period, such as one year, the alternative being a loss of money for that same period.

This feature makes an IUL to be an incredibly strong contender in any retirement planning scenario, because the combination of “Guarantee Against Market Loss” and “Earning Market Like Returns” is a priceless and unique feature that is not available in any other financial instrument.

The “Guarantee Against Loss” feature is particularly valuable during retirement years as the combination of drawing income and a possible market loss can be especially devastating to a retirement account, literally endangering it with running out of money, prematurely.

The methods by which the cash value of an IUL policy earns its interests involve certain terminologies. Here are the main ones: 1) Cap Rate. 2) Annual Point to Point. 3) Monthly Point to point 4) Participation Rate 5) Spread.

What is a “Cap Rate”? Interest earnings in an IUL come from the policy’s Cash Value being linked to a certain index such as the S&P 500 Index. The earnings are typically calculated on a Monthly or Annual basis, and they are “Capped off” at a certain point, let’s say at 10%, in an annual example. This means that all earnings during the year, up to the 10% Cap, will be credited to the policy’s cash value. So, in an example, if the S&P 500 Index experiences an actual annual return of 9%, the entire 9% will be credited to the policy for that one year, however, if the return is 11%, the policy will get credited the 10%, the earning Cap Rate for that year.

The same concept applies to the Monthly Point to Point methodology. So, in an example, if the monthly Cap Rate stands at 3%, that would mean that the policy can earn up to 3% per month.

What is “Annual Point to Point”? It is a method of calculating the annual earnings of an Index that an IUL policy’s cash value is linked to. The starting point of the Annual Point to Point method is typically the policy’s inception date. To earn a credit, the policy must wait for exactly one year. At the anniversary point, the company compares the S&P 500 Index’s standings at those two points of start & anniversary, and if the Index has shown growth within the year, the percentage of the growth is credited to the policy’s cash value. On the other hand, if the Index has declined, and has therefore yielded a negative rate of return, the policy gets a zero credit for that one-year period, instead of losing money. And going forward, that is how the cash value of an IUL, that adheres to the Annual Point to Point method, will earn credits, year after year, with zero being its’ worst-case scenario.

What is “Monthly Point to Point”? This crediting method is similar to that of the Annual Point to Point, however, it presents more potential as well as more risk. The monthly credits are calculated by comparing the Index standings on the two points of a 30-day period, the starting day and the 30th day after that. This monthly calculation is done every month for 12 months, and by the end of the 12th month, the monthly results are added in order to come up with one crediting rate which is then applied to the policy’s cash value. Since in an IUL zero is always the floor, if the 12-month sum would yield a negative rate of return, zero credit will be applied for that one-year period.

The Potential & Risk of the “Monthly Point to Point” Method: The monthly point to point crediting method has a tremendous earning potential in a strong economic year when an Index may experience growth every month. To understand it better, let’s look at an example: Let’s assume a monthly cap rate of 3%. This means that the policy has the opportunity of earning up to 3% per month if the corresponding Index, i.e. S&P 500, goes up 3% or more per month. Now, let’s also assume that the Index does in fact go up 3% or more every single month of that particular year. In such a scenario, an IUL policy will make 36% for that year! Here is the calculation: 3% credit per month times 12 months, equals 36%!

The flip side of this method’s upside potential is that on the downside, it does not have a Floor Rate, or a “Loss Cap”. This means that if, for example, the S&P 500 Index experiences a 6% decline in a poor month, the entire 6% loss for that month will be used in adding up the monthly returns of a 12-month period. The lack of a “Floor” in this crediting method will therefore mean that the presumptive 6% decline can wipe out two months of a full 3% Cap rate returns. However, it should be noted that even in a poor year, when a policy may experience several months of declines, resulting in an actual negative rate of return for the year, the policy will still be credited with zero, avoiding losses. Because, in an IUL, zero is always the overruling final floor rate, regardless of the crediting methodology used. So remember, in any market decline, zero is the hero, because it’s much better than losing money!

Funding of an IUL: The funding an IUL should be designed in accordance to the policy owner’s insurance and financial goals. It would therefore be extremely important to work with only an experienced and knowledgeable agent who would be able to do a thorough interview, known as fact finding, in order to present a sensible and viable plan.

Generally, the two main purposes of purchasing an IUL are:

1) The accumulation of a considerable amount of cash value for a variety of purposes such as a tax-free retirement income, college funding, business opportunities, etc. To utilize IUL for such goals, it must be funded maximally which in turn will cause the policy’s internal costs to be minimized. In a reduced internal costs environment, most of the policy’s premiums enter the cash value to earn interests instead of being used to pay internal expenses. Such IUL policy designs are called Maximum Funded IULs.

2) To own a low-cost life insurance policy that is mainly intended for protective purposes. In this type of a scenario, cash value accumulation is either a secondary concern, or not a priority at all. These types of IUL designs are called Minimum Funded IULs, and they require the lowest amount of premiums that are just enough to hold up the policy for as long as the insured lives. A minimum funded IUL can also be designed to be paid off in a certain time period such as 15 or 20 years, just like a home!

Living Benefits in an IUL! Besides being a life insurance, today’s IULs offer an additional peace of mind by including generous “Living Benefits” rider in the policy. The Living benefits rider protects the insured against the costs associated with certain chronic, critical,or terminal illnesses, and, it does so by allowing partial access to the policy’s death benefit while the insured is still alive.

The following is a generalized definition of the types of illnesses that will trigger the Living Benefits of a policy. However, while the general features and definitions might mostly be alike amongst companies, the details, in terms of disbursement rates and associated time periods, might differ slightly.

- Chronic Illness: It allows for the liquidation, or “Acceleration”, as it’s known in the insurance language, of up to 90% of the death benefit amount, if the insured loses the ability to perform 2 out of the 6 Activities of Daily Living (ADL). Depending on the severity of the illness, between 5% to 24% of the face amount is paid out yearly, until the 90% maximum is reached. The Activities of Daily Living are consisted of 1) Bathing. 2) Dressing. 3) Toileting. 4) Transferring. 5) Continence. 6) Eating.

- Critical Illness: This feature allows for the one-time payment of between $2,500 and 90% of the face amount, depending on the severity of the illness. The qualifying critical illnesses are Major heart attack, Coronary artery bypass, stroke, invasive cancer, major organ transplant, end stage renal failure, paralysis, coma, and, severe burn.

- Terminal Illness: Under this feature, between 75% and 100% of the death benefit can be disbursed if the insured is diagnosed with a terminal illness with a life expectancy of 12 to 24 months.

A QUICK SUMMARY: For the purposes of wealth accumulation, IUL is a comprehensive and sophisticated financial vehicle that carries many of the most favored tax and investment related features, all under one roof.

An IUL offers the opportunity to make Market Like Returns while preventing losses by crediting zero during adverse market periods. These features combined with its’ ability to grow cash and disburse income, all tax free, as well as the death benefit to also be transferred tax-free, make an IUL to be a potent and superlative financial instrument.

- Three Important Points to Consider: A) An IUL’s ability to generate Tax-Free Income is achieved through properly designed policy loans. B) The success of an IUL is directly contingent upon the integrity, knowledge, and experience of the financial professional that is designing it. C) Like all the other permanent life insurance types, IUL is also a long-term financial product. Therefore, a minimum of 15 years should be considered for its’ cash value to become viable. In a way, just like a 401K!

For a Complete Tailored IUL Illustration,

Complete with

Tax Free Income, Exprense Analysis, and Rate of Return Ledgers

No Cost, No Obligation!

Whole Life Policy: Whole Life is the oldest and most traditional type of permanent life insurance. Unlike a UL or an IUL which have flexible premium options to meet different goals and or hardships, Whole Life’s premiums are typically fixed and on the high end.

The earnings in a Whole Life policy are known as “dividends” which are theoretically defined as a life insurance company’s available surplus money, after paying all its expenses and obligations. A Whole Life policy offers a guaranteed death benefit, as well as cash value. However, the guaranteed cash value amount is minimal, and much lower than the policy’s actual performance under current conditions. The guaranteed column of a life insurance policy is typically indicative of a worst-case scenario that can ever take place, however, the probability of its’ occurrence is almost always very minute, and statistically null.

“Paid-Up Additions”, What are they? Paid-Up Additions can be looked upon as small amounts of life insurance that the policy purchases and adds on to the original death benefit. So, the death benefit of a Whole Life policy tends to increase by small amounts each year. The “Paid Up Additions” are purchased by the policy dividends that are also declared each year. By adding the Paid-up Additions rider to a Whole Life policy, the cash accumulation potential of a Whole Life policy increases substantially. Therefore, in order to have a strong cash values & death benefit, adding the Paid-Up Additions rider would in fact be imperative and the way to go.

Limited Pay Whole Life: These are types of policies that are designed to be paid off in a “Limited” time, such as 10 or 20 years. After the “Limited” period, the policy is guaranteed to stay in-force for as long as the insured lives. The premiums of such designs are naturally higher than a regular Whole Life policy, but, they are cumulatively lower by a considerable amount if the insured lives an average life span.